Empower App Review: Instant Cash Advance

If you want to compensate for your financial requirement with an instant cash transfer to your bank account, then this Empower App review is for you. The app provides emergency funds to improve your financial health until you get your paycheck. Moreover, you can benefit from budgeting and banking features. To make it a worthwhile option, we will disclose several application features. Let’s check out the analysis:

Empower App Review

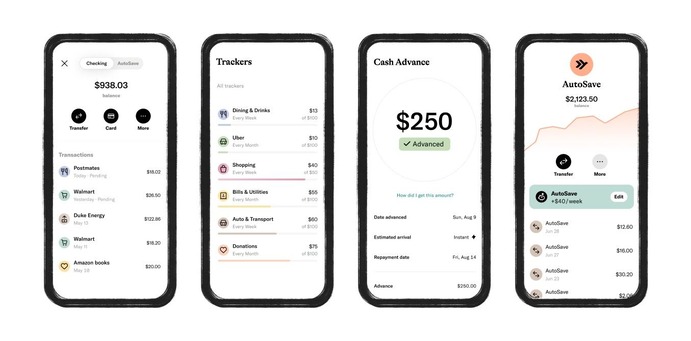

In the Empower app personal finance review, you will meet several features that may or may not be valuable to you. However, you may get all the fundamental segments in demand from all other cash advance apps. This financial tech company helps you make money to spend and save for future necessities. It tracks your economic conditions to give an exact solution to mark yourself on top-notch saving habits. The short-term cash fund is at no interest up to $250. Everything will be flawless if you act according to the Empower review app. It is an eventually dedicated personal financial expert app- for Americans- who have some kind of financial stress and instability with their income sources.

Let’s see some pros and cons to understand where you have to rely on it & where not.

Pros

- An alert for not paying an overdraft fee

- Budget-friendly features or tools

- An easy and random way to borrow money

- Interest-free fund

- Access early paycheck

- Cash-back rewards on conditioned purchases

- Generate savings habits

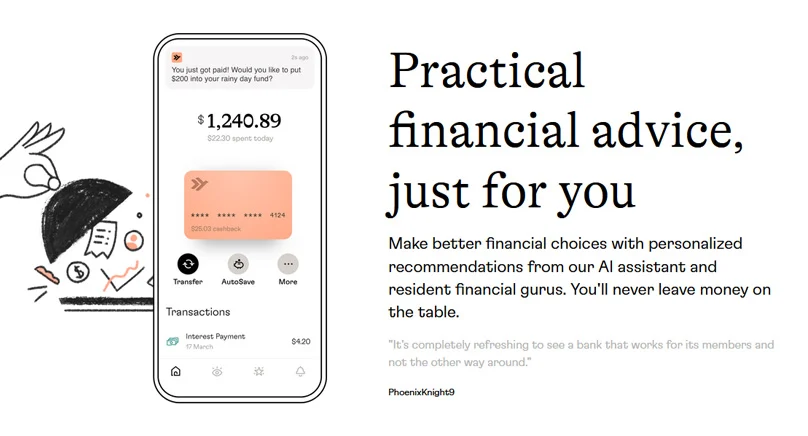

- Savvy Recommendations

Cons

- Need bank account link

- Generate borrowing habits along with savings habits

- Monthly subscription

- Information findings

- Increased interest from missed repayments

- No borrowed amount customization

How Does the Empower App Work?

The app works enough to let you come out of your financial crisis. It transfers funds into your account, but before that, it gets assured not to bear any loss from your side while dealing with you. On that note, there is an Empower banking app review process that you can’t trick. Let’s see how you can access the app.

- Visit the Empower Website and share your mobile number in the preferred section.

- As you give your mobile number to the web address, you will receive an invitation from the service providers.

- Now, you can download the app from the Google play store or the Apple App store.

- After the proper installation, open the app to create and set up the account with verified and recognizable details.

- You need to give some information apart from your full name. SSN or Social Security Number, Your Birthdate, Email address, and an active bank account.

Qualifications for Empower App Review

- The user should be 18 years or later to download, register, use and access the cash advance amount and app.

- You need U.S. residential proof to access the Empower app bank account.

- Apart from that, you must have a Social security number.

- The other bank account should be older than at least 30 days.

- Make sure to have relatively 2- deposits out of 3 months’ time duration with a $200 amount.

- If you correctly have these things, you may definitely qualify for the cash advance with the appropriate loan payment limit.

Features of Empower

From subscription-based Empower app features, we have listed some of them for your reference.

- Empower Card

- Budgeting Tools

- Interest-free paycheck advance

- Cash-back

- Saving hacks

How to Use Empower App?

After successful account verification, you can use the Empower app. However, you need to go through one more empower finance app review procedure while requesting advance from the app. Let’s see how it goes on.

- You need to connect one checking account to allow Empower to track consistent deposits of your account.

- Now, you can make the advance payment request to check how much sum it can offer you.

- After receiving the eligibility limit, you can decide whether- you want to borrow the money; or not.

- While borrowing the money, choose the instant delivery fee or the optional tip amount.

- You can’t decide on the lower loan amount and will have to wait for two days, not going with an instant delivery fee.

- Spend the money on your pending bills and repay the amount on time to get hassle-free service for future shortages.

Empower App Review for Fee and Repayments

Fee

- The instant delivery fee requested by the Empower App varies for qualified loan amounts from 2-8 dollars.

- The trial period ends after 14 days. Once it expires, the subscription package imposition will start at $8 per month.

- You need to pay up to 20% of the transferred amount as an optional tip.

Repayment

- It keeps a track record of your income and expenditure from the direct deposit system activated on your account.

- Based on that track record, it automatically deducts the transferred amount on your paycheck day.

- Furthermore, if you subscribed for any instant delivery fee or optional tips, that will be the plus amount.

- Most importantly, you can inform Empower of the modification on the repayment date.

Is Empower App Safe?

Yes, the amount you acquired in your bank account first gets insured from the hands of FDIC and comes to you. The banking services are the output of a partnership with NBKC (an active and certified member of the Federal Deposit Insurance Corporation). It uses AI technology to use and manage the details you share while registering on the app.

The Bottom Line

You may have various options to rectify your financial problems. However, you may or may not find everything relevant for your purposes. After a detailed Empower app review, we are confident you may have some boundaries. However, those boundaries will give you better than others, like budgeting and saving habits in your mindset. If you want to solve all your money-related troubles, you must register on the app to empower yourself with the Empower App.

See our other reviews also:

Frequently Asked Questions

Q.1 Does Empower App Provide Cashback?

Yes, the account can secure up to 10% cash back on all your secured transactions.

Q.2 What if When You don’t Have a Sufficient Amount for Repayment on Empower App?

If you don’t have the total amount for repayment, Empower may negotiate for the part of the payment at the initial level and give you time for the complete settlement from the checking account.