Brigit App Reviews: Know All About Brigit

If you have an issue with your financial well-being and are looking for a solution until you get through your paycheck day, then you can use Brigit. It is a fintech company that supports you with a fixed amount based on your requirement and eligibility. Not just paycheck, it has several other highlights to use your advances to the fullest. To make you aware of every part of the services from the app, we have covered the Brigit app reviews in this article, analyzing various factors. So, let’s move on to knowing the effective use of the app.

What is Brigit?

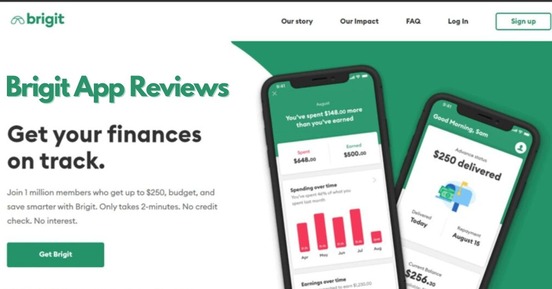

It is a financial app to get a paycheck in advance to dispute your emergency needs and credit history. Furthermore, it helps you in budgeting without an overdraft fee. Americans usually prefer payday loans to settle their bills. On that note, financial fintech like Brigit reviews has higher demand in the state. Brigit is on a mission to secure the interest of millions of Americans: as per the statement of Co-founder/CEO Zuben Mathews. Apart from that, you can choose either paid or unpaid services. For advanced features, there is a subscription package of $9.99/month.

Pros

- No Credit Check

- Up to $250 loan

- No overdraft fee for automatic advances

- Credit monitoring

- Budget Tracking

- Credit Builder Loans

Cons

- $9.99 monthly subscription fee

- Bank account activity check

- Less loan limit

- Promote borrowing habits.

- Lower withdrawal Amount

- Unavailability of instant direct deposit.

Is Brigit Legit?

Brigit is legal and not a scam. All the features that the company provides to the account holders can get monitored by the administrative authorities. Moreover, you have the best option to get your bills paid when you have no money, even if you are working somewhere and your paycheck has time to come into your hands. The best evidence is its Brigit payday loan review for credit buildup loans. That service provides every piece of information about your performance to the three credit bureaus.

How Does Brigit Work?

In the Brigit loan review, we found these simple steps to access the Brigit app.

- Open Google Play Store or Apple App Store to download the Brigit app and complete the installation.

- Set up the account with asked details to link the checking account.

- Once you link your checking account, Brigit reviews the information provided by you to avail of your cash advance.

- After Brigit payday loan review, the fintech informs you about the amount you qualify for.

- If you accept the subscription fee, Brigit will transfer the amount immediately and inform you of the repayment date.

- In its working structure, it will inform you two days before the payday loan repayment on time. On the other hand, it accepts advance payment.

Qualification for Brigit Paycheck Advance

It prefers the checking account to make you qualify for the Brigit loan review process. In its assessment, it figures out the following.

- You must have a 60-day-old bank account with continuous paycheck statements.

- Enough activity should be there with the linked bank account.

- Minimum balance as per the bank standards.

- Enough amount to repay the loan on time.

- It verifies your income and spending to score you for the loan qualification.

Why Should You Consider Brigit App?

Brigit provides information about the app’s usefulness in your financial lifestyle.

- Emergency Expenses: From the Brigit app, you take up to $250 to settle your emergency expenses on the paycheck direct deposit system guarantee.

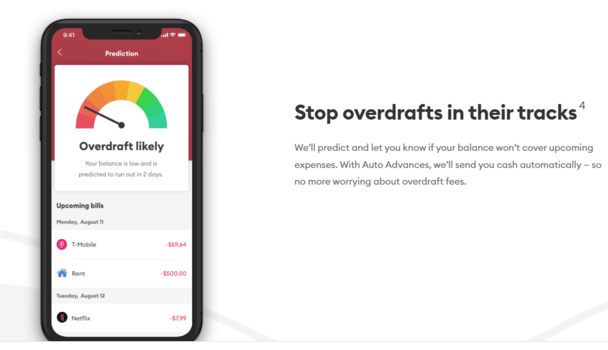

- Avoid Overdraft Fee: It has an automatic advance feature that transfers the money when it detects an excess withdrawal to save the overdraft fee.

- Active Account with Direct Deposit: With this mode, Brigit can instantly take the loan amount back without your information from your account.

How to Delete Brigit Account?

Free Plan Account Delete

- Sign up for the Brigit Account and go to “Settings.”

- Click on “Delete My Account.”

- Select the “Confirmation” button to delete the account.

Brigit Plus Membership

- Login to the Brigit account.

- Go to the “Settings” option.

- Click on “Your Membership.”

- Tap on “Switch to this Plan (Free Plan).”

- Scroll down for the green text “Pause or Switch Plan.”

- Again Scroll down and select the green text of “Switch to the Free Plan.”

- Choose the account closure reason and click “Submit and Switch to Free.”

- Return to the “Settings.”

- Choose “Delete My Account.”

- Click on the confirmation button to delete the account permanently.

Brigit App Reviews: Customer Ratings

The app is available on the Google Play store and Apple store for easy customer access. Satisfied customers have given their reviews and rated the app with 4.8 on the Apple Play store and 4.6 on the Google Play store.

Conclusion

The American market is full of thousands of fintech apps. They provide all the essential services to counter your financial crisis. However, some terms and policies can make you feel unsatisfied with them while accessing their features. On the contrary, the Brigit app reviews have shown us a different picture of payday loans. The Brigit users can access the account for basic and advanced features depending upon their requirements. Furthermore, it saves your overdraft fee with instant money transfers following your bank statement and activities.

See our other reviews also:

Frequently Asked Questions

Q.1 Does Brigit provide a Credit Buildup Loan?

Yes, Brigit provides credit buildup loans to make your credit history and credit score giving timely information to credit Bureaus.

Q.2 What is the Maximum Limit for Brigit Payday Loan Amount?

You can get up to $250 for the Brigit payday loan.